Life Insurance in and around Murray

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It may make you uncomfortable to entertain ideas about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can show care to the ones you hold dear.

Insurance that helps life's moments move on

What are you waiting for?

Life Insurance Options To Fit Your Needs

The beneficiary designated in your Life insurance policy can help cover important living expenses for your partner when you pass. The death benefit can help with things such as childcare costs, phone bills or future savings. With State Farm, you can rely on us to be there when it's needed most, while also providing compassionate, reliable service.

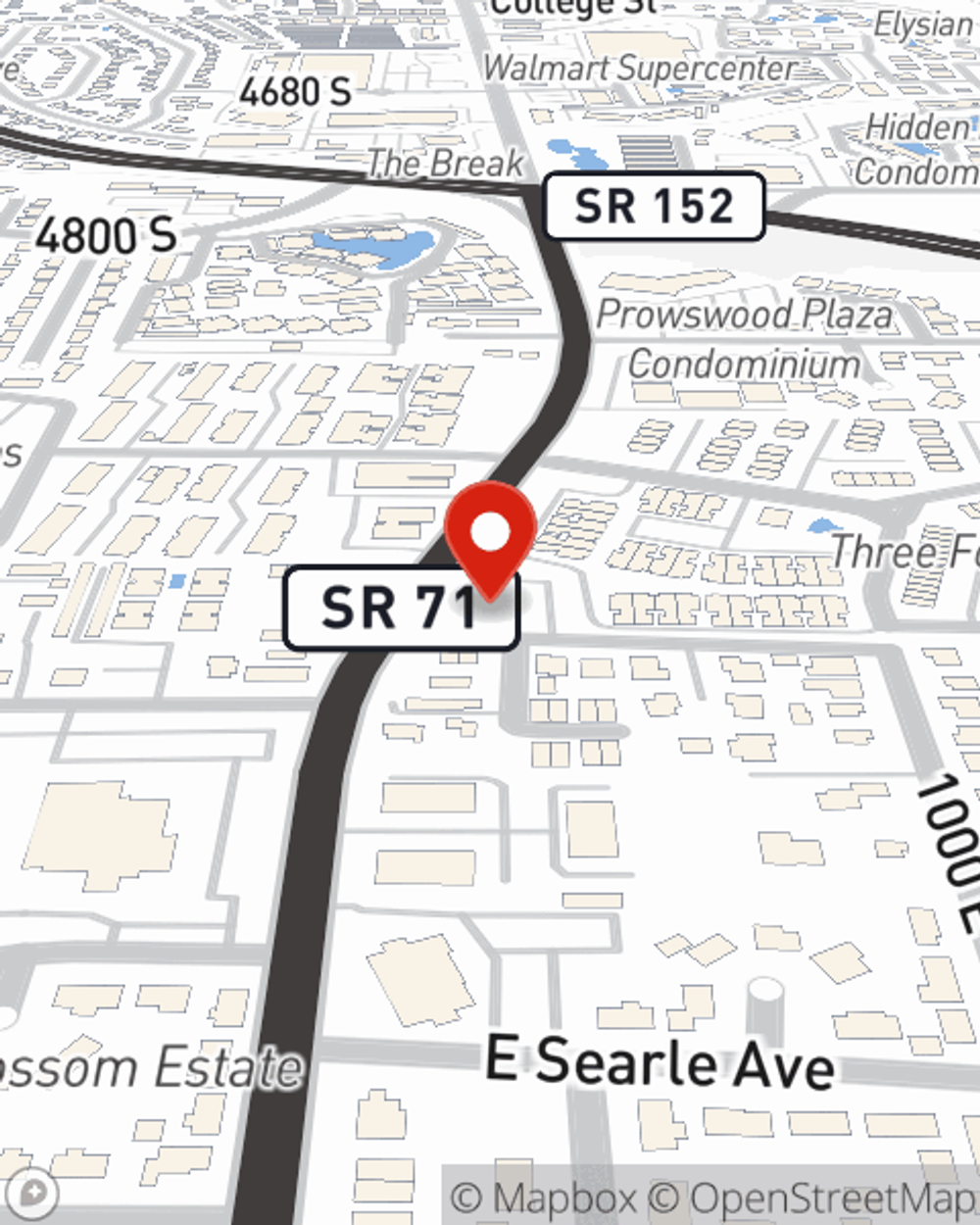

If you're looking for dependable coverage and caring service, you're in the right place. Contact State Farm agent Cinthya Molina today to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Cinthya at (385) 528-0662 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Cinthya Molina

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.